Announcing Menterra social impact fund 1

By Aditi Seshadri | aditi@menterra.com | +91-9867552332

New Rs 40 crore impact investment fund for early-stage social enterprises working in education, health, agri, energy in India; up to Rs 4 crore funding per startup

Bangalore, India – Menterra Venture Advisors announced the launch of the Menterra Social Impact Fund I, at an exclusive event for key stakeholders in the impact investment space today. The event provided a platform to offer an overview of the impact investment landscape in India and introduce the fund and its goals to the investment and entrepreneurial community in India.

Menterra Social Impact Fund I is a Rs 40-crore impact investment fund that will invest in early-stage social enterprises working in the sectors of education, health, agriculture and energy. The fund will offer startups funding of Rs 1 crore to Rs 4 crore at the critical early stages of their business, where there is currently little funding available. “Existing capital for social enterprises either comes in very small ticket sizes or very large ticket sizes at the later stages of a company’s life cycle, so there has been a big missing middle. Menterra hopes to fill this gap between friends-and-family investment and first round Series A investment,” said Paul Basil, Founder and CEO of Villgro and advisor, Menterra Venture Advisors.

‘Menterra’ stands for ‘Land of Mentoring’ and this new fund will also provide entrepreneurs much-needed support in the form of senior resources who can help guide the business, sector experts who can think through mitigation strategies and an experienced team that will work closely with the startups. The tagline of the fund is “Beyond Risk Capital”, underlining the fact that it intends to provide more than just funding.

“Entrepreneurs are often told to approach investors once they get better traction or once they are closer to getting revenues. But even getting to that stage from the idea stage requires a lot more support than what is available in the market,” said Mukesh Sharma, cofounder of Menterra Venture Advisors. “We will not be passive investors; we will be spending a lot of time on the ground with the entrepreneurs through our team and mentors.”

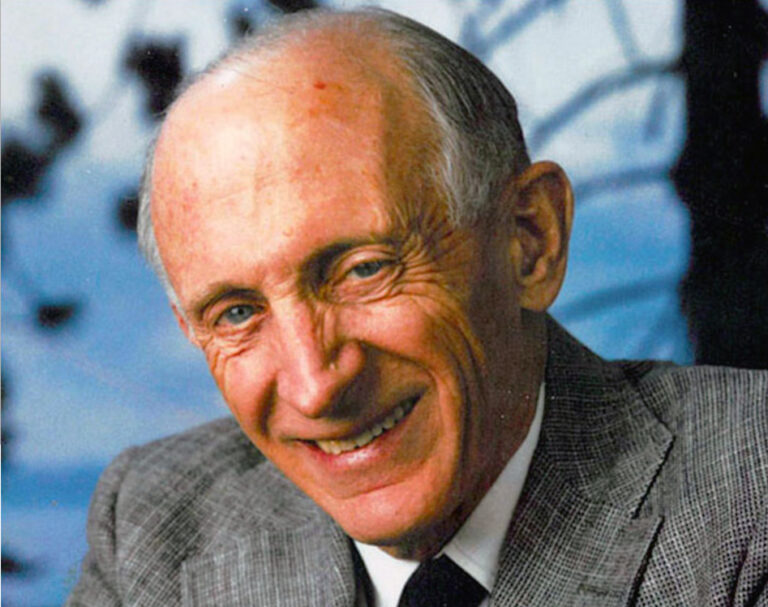

Menterra Social Impact Fund I has secured investments from prominent angel investors like Chandu Nair and Meenakshi Ramesh; and international organisations known for their efforts to promote social enterprise in India such as The Lemelson Foundation and the Michael & Susan Dell Foundation.

“The Michael & Susan Dell Foundation has been a strong supporter of scalable, marketbased enterprises that offer high quality, affordable education and skill training services to urban low-income children and youth. However, we realized that enterprises in this space have lacked access to early stage capital and mentoring support, both of which are critical for long-term success. Menterra’s approach in designing the fund with a blend of social and commercial objectives, and a focus on the requirements of early-stage companies in select industries impressed us. We look forward the long-term impact Menterra will have on the market,” said Geeta Goel, Director of Mission Investing at the Michael & Susan Dell Foundation.

“Over more than a decade of working in India, we’ve seen that there’s definitely a lack of capital for early-stage enterprises, and in particular invention-based enterprises that address critical needs of underserved communities in the region,” said Carol Dahl, executive director of The Lemelson Foundation. “This fund is perfectly positioned to address a growing need that will help these companies reach true impact.”

Menterra will collaborate closely with social enterprise incubator Villgro to support and fund for-profit social enterprises operating in India. Between the two entities, entrepreneurs will now have the benefit of a spectrum of funding starting at Rs 10 lakh and going up to Rs 4 crore, as well as a host of other services. The main criteria for fund investments are entrepreneurs who are serious about social impact, profitability of the business model and the potential to scale to have an impact on millions of lives.